(Co-authored with Lekha Chakraborty)

The Terms of Reference of Finance Commissions have expanded over the years, but concerns arising out of gender inequality have never been a part of ToR. This has happened in spite of the growing realisation that it is necessary to deal with gender inequality issues with respect to fiscal decentralisation.

Asymmetry in revenue and expenditure assignments gives rise to horizontal and vertical imbalances in fiscal federalism. The intergovernmental fiscal transfers are primarily to address this fiscal asymmetry. In India, Article 280 of the Constitution establishes an institutional framework to facilitate transfers from the central government to states. The core mandate of the Finance Commission, as laid out in Article 280, is to make recommendations on “the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them.”

Since 1951, 14 finance commissions (FC) have submitted their reports to the government. The FCs have used different formulae for inter se devolution of each states’ share of central tax revenue and it has evolved over time according to the needs of the situation. The devolution formulae as adopted over time have reduced the weight on fiscal need indicators (like population), increased the weight for measures of equity, and introduced some measure of fiscal efficiency. Income distance criteria was used for the first time by the Eighth FC to make transfers more equitable. Similarly, criteria such as tax effort, infrastructure index and fiscal discipline were used by different FCs to incentivise states to better use the resources already at their disposal and to enhance their efficiency. The Fourteenth FC introduced new indicators to take into account demographic and environmental changes.

Although the concept of development is now more comprehensive and non-material dimensions like education, health and access to basic amenities are increasingly becoming more important, India has not yet designed a substantive “equalisation transfers” to address these concerns. The Terms of Reference (ToR) of the FC have expanded over the years, but concerns arising out of gender inequality have never been a part of ToR. This has happened in spite of the growing realisation that it is necessary to deal with gender inequality issues with respect to fiscal decentralisation.

Fiscal decentralisation got a major push in 1992 when the government passed the 73rd and 74th constitutional amendments. The most revolutionary provision is the reservation of one-third of the seats in local bodies for women. However, the same enthusiasm has not been shown when it comes to setting ToR for FCs.

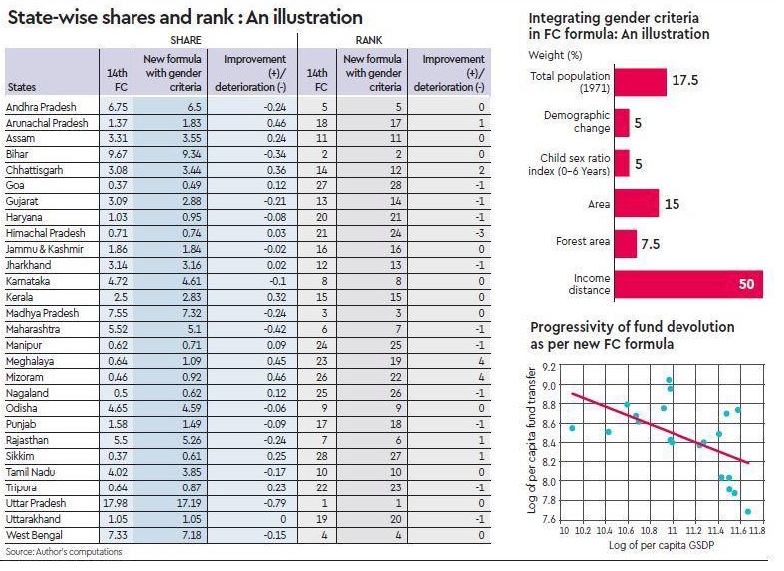

So, how would fiscal devolution look like if we consider some measure of gender inequality for tax devolution? To check for this, we additionally include child sex ratio (female per 1,000 males in 0-6 year age-group) as a proxy for gender inequality as one of the indicators for tax devolution in the formula adopted by the Fourteenth FC. The central idea behind this is to reward those states with a high child sex ratio (CSR) and provide them additional funds based on this indicator so that they can continue to take measures to improve gender equality. Also, the correlation between the CSR and below-poverty line ratio for these 29 states turns out to be 0.33 (i.e., poor states have a better CSR). Thus, inclusion of CSR as one of the indicators rewards poorer states.

State-wise share on the basis of CSR has been calculated in three steps: First, we compute the difference between CSRs of a given state with Arunachal Pradesh (which has the best CSR). Second, we take the inverse of the difference as calculated in the earlier step. Since CSRs for Chhattisgarh, Meghalaya and Mizoram are very close to that of Arunachal Pradesh, their inverse is very high. Hence, adjustments are needed to avoid distortions. Consequently, these states are provided the same value as that of Kerala, which is the next-best performing state. Arunachal Pradesh is also provided with the same value. Third, we add up all the values and calculate state-wise share.

Based on this new formula, we devolve funds to states and calculate their respective shares. The biggest beneficiaries, in terms of share, are Arunachal Pradesh and Mizoram. The share of both these states goes up by 0.46%. Meghalaya and Chhattisgarh’s shares go up by 0.45% and 0.36%, respectively (see table). All these states have performed very well in terms of their CSR, which helped them improve their share. Uttar Pradesh (-0.79), Maharashtra (-0.42) and Bihar (-0.34) are not the gainers of gender-integrated formula. This loss is on two accounts: First, poor record in terms of their CSR; and second, reduction in the weight of demographic change.

The progressivity analysis of fiscal transfers

The scientific basis for a judicious fiscal transfer system is progressivity analysis. As a prelude, we check to see if this gender-inclusive new formula is progressive or not—i.e. whether states with a lower per capita GSDP are likely to receive, on average, much larger transfers per capita or not? As can be seen in the graph, we find that the coefficient of the log of per capita fund transfer with respect to the log of per capita GSDP is -0.46.

The analysis revealed that integrating a gender variable (CSR) as one of the criteria for intergovernmental fiscal devolution has three advantages. One, it incentivises states to improve gender inequality. Two, it makes the fund transfer progressive, as the coefficient of the log of per capita income is negative. Three, it also benefits poorer states, as the correlation between CSR and below-poverty line ratio is 0.33, i.e. poorer states have a better CSR.

The authors are from the Indian Economic Service and an Associate Professor at NIPFP. This post appeared in the Financial Express, November 25, 2018.

The views expressed in the post are those of the authors only. No responsibility for them should be attributed to NIPFP.