In the 25th meeting of GST Council, concerns are raised over shortfall in GST revenue collection. Mismatch of Rs. 34,000 Crore tax liabilities reported in GSTR-1 and GSTR-3B took the centre stage of discussion on GST during last week. The shortfall in GST revenue collection may be due to tax evasion and/or structural changes of the Indian economy. The objective of this note is to explore possible reasons for shortfall in GST revenue collection. Protection of GST revenue is very important to achieve fiscal prudence. Fall in GST collection may result in serious fiscal implications for the Central Government and it may further delay in achieving the fiscal consolidation path suggested by the FRBM Review Committee.1 In absence of expected revenue from GST, the Centre’s commitment for compensation to states for revenue loss on account of GST roll out may cause fiscal difficulty for the Centre. If the shortfall in revenue mobilization continues, there will be need for extra budgetary resources for the Central government to fulfill fiscal commitments. The Union Government has already raised fourth batch of supplementary demands for grants and demand corresponding to GST compensation to States is Rs. 61,215.58 Crore and UTs is Rs. 1,499.99 Crore.2

Expected Revenue from GST

In absence of any recent estimate of revenue under consideration from GST and respective shares of Centre and States in total GST collection, we use the estimates provided in the CEA Report for 2013-14. We use simple method of revenue projection based on annual growth rate of GDP (see Table 1). Here our basic assumption is that tax buoyancy is unitary and it is constant over time. Table 1 shows that expected revenue from GST is likely to be Rs. 1,315,389 Crore for 2017-18. Therefore, monthly revenue from GST is expected to be Rs. 109,616 Crore during 2017-18. Gap in monthly GST collection will vary between Rs. 19,616 Crore to Rs. 29,616 crore if monthly revenue collection varies from Rs. 90,000 Crore to Rs. 80,000 Crore. This shows that there is considerable shortfall in GST revenue collection and it demands an in-depth analysis to identify reasons for such shortfall.

Table 1: Revenue Expectation from GST

|

Year |

GVA at basic prices

(Current Prices, 2011-12 Series) (Rs. Crore)

|

Annual Growth Rate (%) |

Revenue under GST - CEA Report (Rs. Crore)* |

|

|

|

|

Centre |

States |

Total |

|

2011-12 |

8106946 |

-- |

|

|

|

|

2012-13 |

9202692 |

13.52 |

|

|

|

|

2013-14 |

10363153 |

12.61 |

327,728 |

535,722 |

863,450 |

|

2014-15 |

11504279 |

11.01 |

363,815 |

594,712 |

958,528 |

|

2015-16 |

12566646 |

9.23 |

397,412 |

649,631 |

1,047,043 |

|

2016-17 |

13841591 |

10.15 |

437,731 |

740,580 |

1,178,311 |

|

2017-18 |

14897653 |

7.63 |

471,129 |

844,261 |

1,315,389 |

Notes: *Both for Centre and States’ revenue under GST is estimated (beyond 2013-14) based on annual nominal GDP growth rate. For States, beyond 2015-16 revenue under GST is estimated based on nominal annual growth rate of 14 percent.

Source: EPWRF and CEA Report

Whether the present GST is revenue neutral?

In absence of tax rate-wise collection of GST revenue and any reliable estimate of the tax base, it would superfluous to argue either in favour or against of revenue neutrality of the present GST. However, it will not be an exaggeration to argue that multiple rate structure is not conducive for revenue protection especially when possibility of misclassification of sales (either intentionally or unintentionally) cannot be ruled out. Similarly, overcoming price based tax setting approach (e.g., footwear costing up to Rs. 500 will attract 5 percent GST, whereas the rest will attract 18 percent GST) is important to plug the possible scope for misallocation of sales into low tax bracket commodities. Moreover, frequent changes in structural and administrative features of GST are not conducive to achieve stability in the GST system. A stable tax system is desirable for facilitating tax compliance, ease of tax administration and protection of revenue.

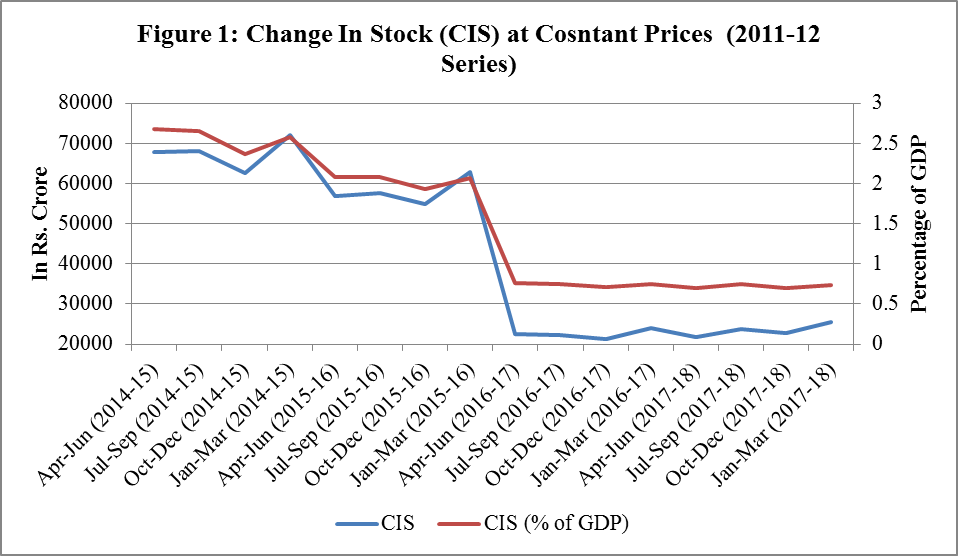

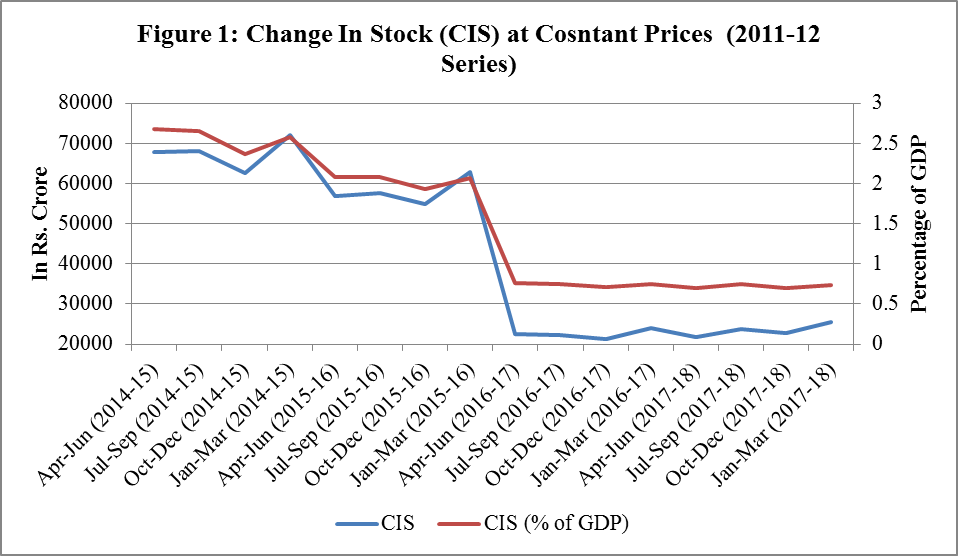

New Normal in Inventory / Stock In Change

Current tax collection not only depends on current consumption but also on input-taxes embedded in inventories. If there is any fall in the level of inventory, manufacturers get relief from the burden of input tax liability as they adjust their input tax credit with output tax liability and pay the balance tax to the government. Relative shares of input tax and output tax liabilities will be different for different stages of value addition, as it will depend on relative contribution of the stage in value addition in total value added in the good. Holding inventory is undesirable for businesses as it requires blocking of cash flow (credit), provided prospect for future price increase is not lucrative. The time period between rising input tax liability and output tax liability varies across commodities depending on relative size of backward linkages (input chain) and frequency at which inventory rolls over in the market. For an economy having low level of inventory means input tax liability blocked in stock is low and therefore there is possibility of lower tax collection on account of input taxes. Figure 1 shows that a dramatic fall in inventory has happened since the beginning of financial year 2016-17. The difference in average quarterly stock between 2014-16 to 2016-18 is Rs. 39,865 Crore or 1.57 percent of GDP. The reason for such a fall in inventory since 2016-17 may be result of expectation of GST introduction and tax treatment of inter-state trade. In the GST regime, inter-state trade attracts IGST rate which is substantially higher than earlier CST rate, as a result businesses avoid blocking a considerable cash flow (credit) by building up stock of inventory. This is especially true for businesses where inter-state transactions are involved in sourcing of inputs. Frequent changes in tax rates could also be another possible factor which certainly influences decisions of the businesses. However, if we assume that the present level of inventory is a new normal for Indian economy, we should also accept that GST quarterly revenue collection would be lower by Rs. 5980 crore (for an average GST rate of 15%). The fall in inventory level will result in level (scale) correction in GST revenue collection. Perhaps this aspect of revenue shortfall was not perceived by the policy makers earlier.

Tax Evasion

Tax evasion takes many shapes and formats and the most prominent among them are un-invoicing and under-invoicing. However, it is comparatively easier to tackle the menace of un-invoicing as compared to under-invoicing. As an illustrative example, we will explore sectors where under-invoicing is possible either due to market condition and/or nature of transactions. Possible scope for under-invoicing is higher for commodities which are high in value but low in volume, attract high tax rate, face less competition in the market and possibility of invoice based sales is low (e.g., tobacco products, alcoholic beverages ). For such sectors MRP cannot be enforced and therefore these sectors are evasion prone in nature. There are several sectors which may qualify such conditions. As a case for example, charging price of tobacco products (mostly cigarettes in either loose form or in packet) over and above the MRP may be cited here. One possible reason for such over-charging could be that manufacturers of such tobacco products do not leave any trade margin for dealers and retailers in setting MRP. However, dealers and retailers charge their respective trade margins from consumers by jacking up the price. In this process, manufacturers underprice the sales by not charging due dealers and retailers margin in the MRP. Therefore, invoice value of sales goes down and corresponding tax is saved. In general over charging varies 20-25 percent above the MRP and therefore for a packet of cigarette of MRP of Rs. 100 (10 cigarettes with filter length not exceeding 65 mm), additional Rs. 20-25 is generated by dealers and retailers for which due tax (Rs. 6.60 to Rs. 8.25 per packet of 10 cigarettes, comprising @28% GST rate +5% GST Compensation Cess but excluding specific rate of GST Compensation cess) is not paid. Depending on any reasonable assumption on daily average sales of tobacco products, one could easily estimate the magnitude of tax evasion could happen due to such under-invoicing. Prior to GST, tax liability of tobacco products used to vary across States depending on tax rates and therefore possibility of variations in MRP cannot be ruled out especially when it is difficult to print different MRP for different states for same brand of cigarette. However, after harmonisation of tax rates under GST, it was expected that MRP based sales will be enforced. Therefore, if there is any over-charging of tobacco products it can be attributed to tax evasion. It is expected that tax administration will further explore possible scope for tax evasions in other sectors to protect revenue under GST.

The recent initiatives of the government to implement ‘e-way bill’ to track movements of goods and IT based approach of matching invoices may be effective to tackle tax evasion which are un-invoicing in nature. However, such instruments may not be effective to tackle the menace of tax evasion through under-invoicing. There is need for adoption of consumer incentive based approach to identify sectors prone to under-invoicing.

The author is Associate Professor, NIPFP. Click here for detailed profile.

The views expressed in the post are those of the author only. No responsibility for them should be attributed to NIPFP.