In the Union budget 2018-19, the government has not made any change in income tax rate, but has made substantial changes in cess types and rates. During the financial year 2017-18, the Union Government abolished more than 20 types of cess and introduced GST compensation cess. In the current budget, it has introduced health and education cess at 4 percent, by combining with previous ‘education cess’ and ‘secondary and higher education cess’, and also, increased the rate of Road and Infrastructure Cess (Duty of Excise on Motor Spirit and High Speed Diesel Oil). Different types of cesses have been introduced continuously by previous UPA and current NDA governments at different times.

‘Cess’ is not a new concept in the Indian tax history, as it used to be levied by local bodies and then by State governments for any particular purpose. In India, we considered ‘cess’ as earmarked tax. Cess is different from other taxes for two different reasons. As mentioned, it is earmarked for any particular programme; and cess, in usual cases, is a non-sharable revenue receipts by Union government, there is no need to share with State governments. However, GST compensation cess has been imposed in order to compensate states due to the loss occurred to State governments by introducing GST.

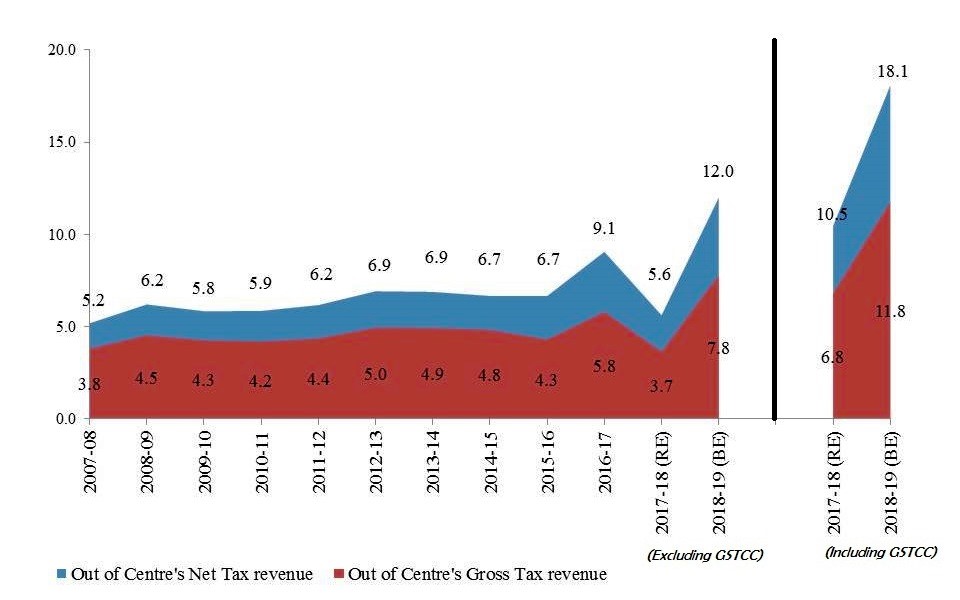

Does the abolition of many cesses cause a reduction in tax revenue or not? Looking at the cess collection by the Union government, in 2007-08, the cess amount share upon total tax revenue was 3.83 percent and which is now at 11.77 percent in the 2018-19 budget estimates (BE). If we compare the figure with net tax revenue, cess share was 5.19 percent in 2007-08, which has increased to 18.06 percent in 2018-19 BE. Obviously one major and temporary increment has occurred due to introduction of GST compensation cess. However, excluding the estimated amount of collection through GST compensation cess in 2018-19, the share of cess collection upon gross tax revenue of Union government is 7.81 percent and out of net tax revenue the share is 11.98 percent; which are higher than previous years (Figure 1).

Figure 1: Cess share upon Tax Revenue of Union Government of India

|

2018-19 BE (Rs. in crore) |

Share of Total Allocation (%) |

|

|

Support from Prarambhik Shiksha Kosh (PSK)

|

||

|

Sarva Shiksha Abhiyan |

16600.00 |

63.53 |

|

National Programme of Mid-Day Meal in Schools |

7063.10 |

67.27 |

|

Total amount met from Prarambhik Shiksha Kosh |

23663.10 |

|

|

Support from Madhyamik and Uchhatar Shiksha Kosh (MUSK)

|

||

|

Rashtriya Madhyamik Shiksha Abhiyan |

3648.05 |

86.6 |

|

Interest Subsidy and contribution for Guarantee Funds |

2120.00 |

98.6 |

|

Scholarship for College and University students |

300.00 |

88.2 |

|

Pandit Madan Mohan Malviya National Mission on Teachers and Teaching |

100.00 |

83.3 |

|

All India Council for Technical Education (AICTE) |

420.00 |

86.6 |

|

Grants to Central Universities (CUs) |

900.00 |

14.0 |

|

Support to Indian Institutes of Technology |

850.00 |

15.1 |

|

Support to National Institutes of Technology |

100.00 |

3.3 |

|

Support to University Grants Commission (UGC) |

1700.52 |

36.0 |

|

Support to Rashtriya Uchhatar Shiksha Abhiyan (RUSA) |

1200.00 |

85.7 |

|

Total amount met from Madhyamik and Uchhatar Shiksha Kosh |

11338.57 |

|

|

|

Total |

Amount met from PSK |

Share of PSK (%) |

|

|

Rs. in Crore |

||||

|

Sarva Shiksha Abhiyan |

2016-17 |

21685.42 |

13345.00 |

61.54 |

|

2017-18 (RE) |

23500.00 |

13174.60 |

56.06 |

|

|

2018-19 (BE) |

26128.81 |

16600.00 |

63.53 |

|

|

National Programme of Mid-Day Meal in Schools |

2016-17 |

9475.43 |

5473.06 |

57.76 |

|

2017-18 (RE) |

10000.00 |

5965.20 |

59.65 |

|

|

2018-19 (BE) |

10500.00 |

7063.10 |

67.27 |

|

|

Rs. in Crore |

2015-16 |

2016-17 |

2017-18 RE |

|

Total Expenditure of Department of School Education and Literacy & Department of Higher Education |

67239.15 |

72015.76 |

81868.71 |

|

Total Education cess and Secondary & Higher Education Cess |

28023.03 |

30248.07 |

29137.85 |

|

Share of Cess (%) |

41.68 |

42.00 |

35.59 |

Source: Union Finance Accounts and Union Budgets.

Similarly, Government has created the Central Road Fund (CRF), under Section 6 of the Central Road Fund Act, 2000. This is a non-lapsable fund and partly funded by road and infrastructure cess (Duty of Excise on Motor Spirit and High Speed Diesel Oil). This fund used for development of State roads, rural roads, railways etc. Also, in 2018, after announcing a hike in road and infrastructure cess, Union Government has announced that CRF will be amended and renamed as Central Road and Infrastructure Fund Act to fund most of the infrastructure sector.

The views expressed in the post are those of the author only. No responsibility for them should be attributed to NIPFP.